I am sure we have all heard about mobile money and the cashless society plans going on around lately. Mobile money refers to the payment services operated under financial regulations and performed from or via a mobile device. A cashless society talks about a system which allows individuals to acquire goods and services without the exchange of something tangible or something that can be touched, e.g. money. This doesn’t mean money is not involved; the only difference is that there is no physical effect in handling it, as it is done through a mobile phone.

Financial institutions have collaborated with mobile telecommunication companies to implement solutions that can provide a platform for transactions. In Nigeria, giants like MTN and Globacom have implemented solutions to see to the success of mobile money and a cashless society.

There are four modules for mobile payment; Premium SMS, Direct Mobile Payment, Mobile Web Payment (WAP) and Contactless NFC (Near field communication).

- The Premium SMS is a payment request via an SMS text message to a phone number to buy goods and services. A text message is sent to the seller and when he receives the text, he delivers s the goods to the buyer. This has its drawback as there is an absence of a trusted delivery system fast enough to make business smooth.

- Direct Mobile Billing is used during checkout at an e-commerce site. Here, a two-factor authentication is involved and a risk management system is present to prevent fraud. Benefits include security, convenience, easy, fast and proven.

- Mobile Web Payments (WAP) where the consumer uses web pages displayed or additional apps downloaded on his mobile device to make payments. It uses Wireless Application Protocol (WAP) as underlying technology and inherits all advantages and disadvantages of WAP.

- Contactless NFC (near Field Communication) which is used in paying for purchases made in physical states or transportation services. The consumer using a special phone equipped with a smart card waves his/her phone near a reader module. It doesn’t require any authentication to carry out any service. There are some mobile phones that make use of this feature like the Blackberry 9360 smartphone.

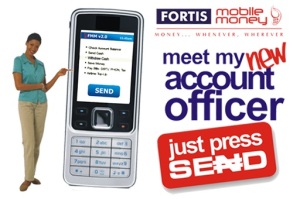

Recently, MTN and Globacom have come up with their mobile money platforms to bring this service to individuals in the society. Very soon, there will be lower usage of normal paper transactions and even credit and debit cards. MTN has collaborated with Fortis Mobile Money, a recently licensed mobile service provider in Nigeria for a mobile money platform. With this solution, Fortis Mobile Money will be readily available to every subscriber on the MTN Network.

Globacom also has their own solution which is called “Glo Txtcash”, in which you can transfer money to any mobile number, spend money directly from their mobile money account to pay for goods as well as buy airtime top-up for themselves and others.

From the look of things, I believe that with the investment of the telecommunication giants, there will be a great shift in carrying cash for purchase of goods and services.

@Demsenforever reporting for Dashawn Enterprise

Follow us @dashawnENT

Very iformative. U think it will be a long while before mobile money can become ubiquitous in a place like nigeria though because people don’t really trust technology that much at the moment. Even ATM adoption rate us not really high, especially among the older ones.

Yes…starting from lagos is key. I remember when people said this about ATM cards. Let’s see how it goes, cashless society might be far away, but it is a good idea and solution.

wat is been done to tackle the problems faced earlier by the POS we hv around us. my major issue of this wud be the availability of this service then security too

well..I want to believe that since CBN is taking this very seriously, there will be a good basis in the implementation. Security will be important in protecting transactions. Let’s keep our fingers crossed.